what is the inheritance tax in georgia

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. The tax is paid by the estate before any assets are distributed to heirs.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

According to the Georgian law On the Legal Status of Foreigners any person whose presence in Georgia is legal may own property leave property by will and enjoy succession rights to property.

. Download or Email T-20A More Fillable Forms Register and Subscribe Now. The following information is required. Georgia has no inheritance tax but some people refer to estate tax as.

Suppose the deceased Georgia resident left their heir a 13 million worth of an estate. It is not paid by the person inheriting the assets. As of 2014 Georgia does not have an estate tax either.

All Major Categories Covered. There are NO Georgia Inheritance Tax. As the home passing to.

All inheritance are exempt in the State of Georgia. Does Georgia have an estate or inheritance tax. The tax rate on the estate of an individual who passes away this year with an estate valued in excess of the exemption is a flat 40.

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. In this case 940000 would be subject to a Federal Estate.

State inheritance tax rates range from 1 up to 16. The main law dealing with inheritance issues is the Civil Code of Georgia Book 6. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. Ad Inheritance Affidavit More Fillable Forms Register and Subscribe Now. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

An inheritance tax is a state levy that Americans pay when they inherit. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the.

There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current fairly high. Trendy nail accessories Mar 14 2022 Plan A to protect assets from long-term care and nursing home costs is to buy long-term care. Georgia does not have any inheritance tax or estate tax for 2012.

For 2020 the estate tax exemption is set. If the deceased persons estate is over 2000000 a Federal. Choy Inheritance Protection Todd Trust Todd Choy.

Completed and signed MV-1 TitleTag Application. Estate tax applies at the federal level but very few people actually have to pay it. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206 million.

The exact federal rules depend on the year in which your parent died. Surviving spouses are always exempt. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle.

New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. Foreigners have the same rights liberties. If you are the recipient of money or property under the will of someone you need not even report the receipt of that money on your Federal or GA personal income tax returnMoneyproperty inherited like this is subject to neither of those personal income taxes.

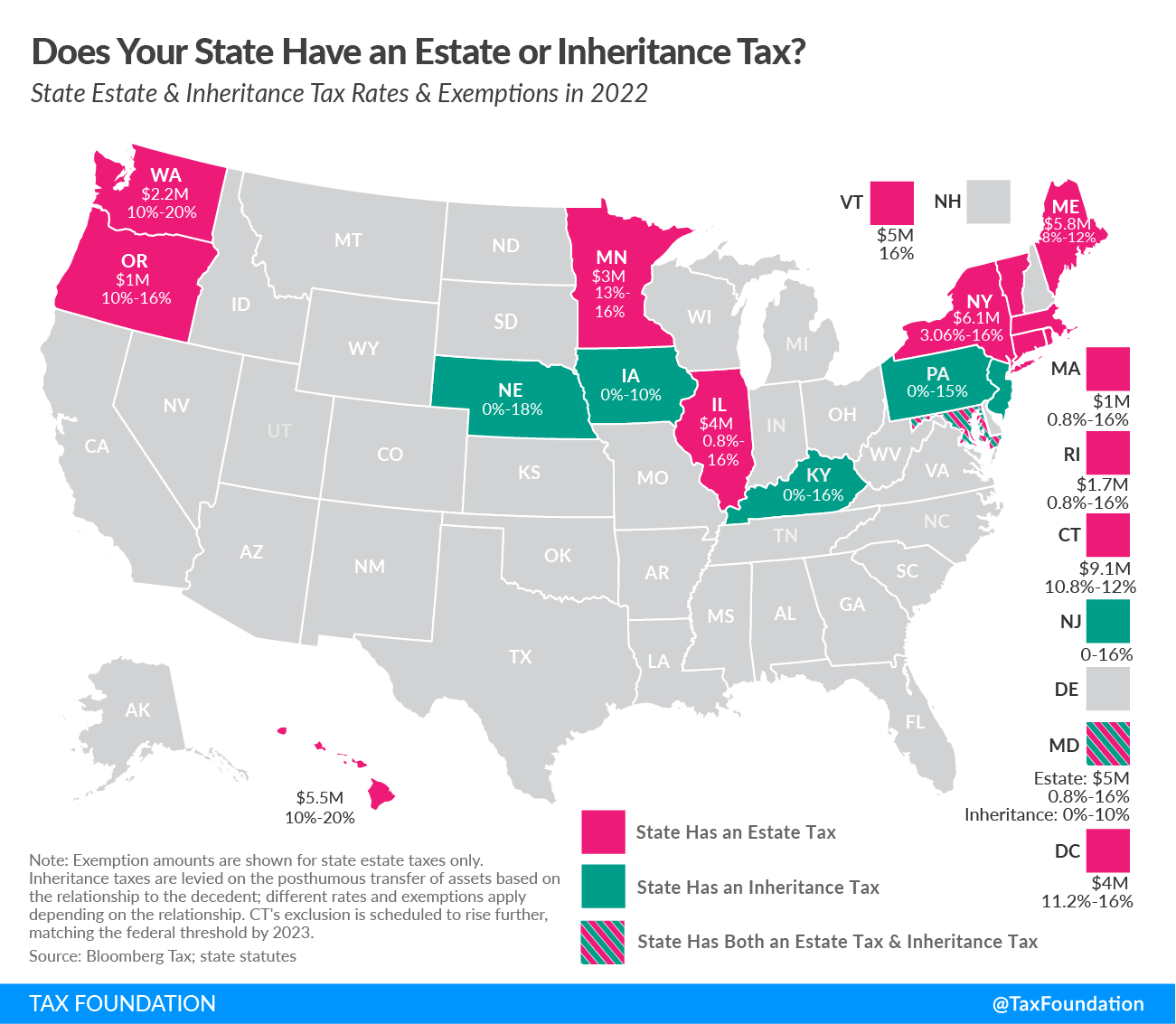

However the federal exemption equivalent was 3500000 for 2009 5000000 for 2010. Georgia does not have an Inheritance Tax. As of 2021 just six states charge an inheritance tax according to the Tax Foundation and many beneficiaries are exempt.

Titles and tags can be obtained at your County Tag Office for a vehicle that has been inherited or purchased from an estate. Select Popular Legal Forms Packages of Any Category. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount.

Find out if Inheritance Tax is due on assets transferred in or out of a trust and on certain trusts at each 10 year anniversary. Original valid title issued in the deceaseds name or properly assigned to the deceased with all recorded liens andor security.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Pierre Bonnard Painting Arcadia Pierre Bonnard Painting Watercolor Paintings Abstract

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Keith Cochran P C Certified Public Accountant Cpa Serving The Chattanooga Area And Northwest Georgia

Center For State Tax Policy Tax Foundation

Georgia Estate Tax Everything You Need To Know Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Is Your Inheritance Considered Taxable Income H R Block

What You Need To Know About Georgia Inheritance Tax

Georgia Estate Tax Everything You Need To Know Smartasset

Effective Rates Inheritance Tax In Usa 1995 Download Table

Inheritance Tax Here S Who Pays And In Which States Bankrate

Effective Rates Inheritance Tax In Usa 1995 Download Table

What Is Inheritance Tax Probate Advance

How Do State Estate And Inheritance Taxes Work Tax Policy Center